Utilising Additional Services to Maximise Sustainability

IN A NUTSHELL: UTILISING ADDITIONAL SERVICES TO MAXIMISE SUSTAINABILITY

Following recent cuts to ACFI funding and escalating costs of care, residential care providers are seeking alternative revenue sources to support the cost of care services.

The legislation is not specific on permitted additional services and while providers argue that they should be free to charge for any service outside of the confines of the Act, the Department of Health has signalled that some practices are “not supported by legislation” and will not be tolerated.

Amenity and Lifestyle Fees

Until recently, additional service fees were limited to “extra service” type fees and included pay telephone services, internet and pay TV.

As residents are required to bear the burden of the cost of care, the demand for services is also increasing. Residents and their families are now requesting a diverse range of amenity and service and the most proactive organisations are responding to this consumer driven market by introducing a variety of novel services to meet both current and future demand.

Many providers are now building homes that are equipped with amenities that are not available to all residents and not considered part of normal operations. The amenities are attracting residents to homes by providing a differentiated lifestyle offering. The amenities also offer providers additional revenue opportunities.

AMENITY STYLE ADDITIONAL SERVICES:

- Private dining

- Private lounge areas

- Furnishing packages

- Personal safe or storage outside of the resident’s room

- Communications Packages (telephone, internet, TV, pay TV)

- Personalised IT support

- Customised equipment

A number of providers, both for-profit and not-for-profit, have introduced “club style” fees in lieu of extra service fees. The fees, either paid as a daily fee or deduction from the RAD, are charged for premium accommodation services and/or specific personal or lifestyle services.

In order to avoid criticism that the club fees are not voluntary for residents entering club rooms, some providers offer the services as a pack, where care recipients choose services from a suite of additional services. Whilst the cost of the package is set, residents have the opportunity to select those services that best meet their abilities and preferences.

Additional services frequently include non-amenity services that involve additional staff contact outside of the realms of Specified Care and Services. Services that traditionally relate to Specified Care and Services are provided as additional offering if the home has determined that there is no assessed need for the service.

Allied health providers, like W&L Services, have proposed alternative service packages that facilitate the charging of additional fees for therapy and wellness packages. The organisation provides separate cost packages for the provision of “routine” services such as clinical assessments, care planning and rehabilitative services provided as Specified Care and Services. Additional packages are offered for programs that fall outside the realms of Specified Care and Services. These packages are more cost effective as they increase utilisation and include intensive multi-disciplinary restorative programs and additional support.

Additionally, homes are targeting services to the friends and families of residents in an attempt to increase community engagement, support socially isolated next of kin and to supplement revenue. Whilst some homes charge visitors directly, others provide residents the option to pay for services utilised by family members, allowing the resident to “host” guests.

ADDITIONAL SERVICES PROVIDED (IN EXCESS OF ASSESSED NEED OR SPECIFIED CARE AND SERVICES):

- Multiple menu choices

- Additional beverage packages

- Concierge services

- Private lifestyle coordinators or “Club Managers” who coordinate additional services and provide further social support

- Personalised companionship services

- Hair and beauty treatments

- Complimentary therapies

- Intensive rehabilitative support

- Additional, personalised outings

- Coordination of non-facility events and outings

- Non-facility, resident-related administration/secretarial services

- Dry cleaning

- Personalised brand selection for continence product and other care items

- Personalised or customised equipment

These services, traditionally offered on an ad hoc or charitable basis, are now being provided on a professional, fee-for- service basis. Rachel Lane, an aged care financial planner advisor and Principal with Aged Care Gurus says “Where the services being provided are valued by the resident (or their family) there is very little resistance to paying the fees. This is understandable in a user pays world where people are happy to pay for what they use. The resistance comes from residents (or families) who don’t use all (or any) of the services. From the operator’s point of view it is an economies of scale issue – it’s very difficult to deliver many of the services to only a handful of residents without the cost becoming incredibly high. At the moment the concept of “opt in and opt out” is very much a case of “you opt in when you choose to live at that facility and you opt out when you leave”.

VISITOR STYLE SERVICES:

- Meal and snack services

- Activity packages

- Medical, nursing and Allied Health services

- Transport services

- Crèche and babysitting facilities

- Counselling and support services

- Administration services

Capital Refurbishment Fees

A number of operators have recently introduced capital refurbishment, asset contribution or room reinstatement fees. The fees have been described as a resident contribution to the refurbishment or replacement of capital (buildings and equipment) as a result of the resident’s stay in the home.

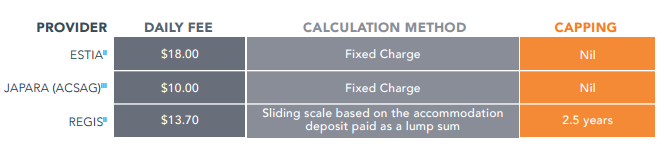

To date, the charging of capital refurbishment fees have generally been limited to larger, for-profit operators. The fees are paid by non-supported, RAD or RAD/DAP paying residents and are charged either as a fixed sum or on a pro-rata basis, dependent on the value of lump sum paid by the resident. Most fees range from $10.00 per day up to $18.00 per day.

The Department has sought to summarise and capture these fees as a collective and say that they are:

- Not for services of the normal operations of the home;

- Not providing direct benefits to residents; and

- Not charged on a fee-for-service basis (i.e. service are rendered in exchange for payment).

Whilst some providers and legal advisers, including Gadens Lawyers, argue that the care recipient enters a voluntary agreement when they elect to enter the home and sign an accommodation agreement, the Government clearly does not agree.

This may have significant ramifications for those proposing to charge “mandatory” fees for capital replacement or refurbishment fees.

Rachel Lane adds that these fees seem to be a bone of contention with consumers – largely because they see the cost as benefiting the next resident and not them. In most cases the fees are deducted from the RAD when the resident leaves creating questions from the beneficiaries of the estate who had an expectation that the full amount was going to be refunded.

When Are Additional Services Permitted?

The Aged Care Act 1997 (the Act) and the Aged Care (Transitional Provisions) Act 1997 regulate the fees that a provider can charge to residents.

The Act states that providers are not permitted to charge more than the ‘maximum resident fees’ calculated under the Act for the provision of care and services specified in the Quality of Care Principles 2014 if the resident is assessed as requiring those services. These services are generally referred to as Specified Care and Services.

A provider can, however, charge some residents (typically more low care residents) for care and services included as Specified Care and Services if they are assessed not to need the care or service. A resident could, for example, be charged for one-on-one overnight companionship if the service is requested but not considered a care need by the home.

Residents cannot be charged for services that are included as Specified Care and Services at any stage, regardless of the assessed need, if they:

- Have a high domain category in any ACFI domains;

- Have a medium domain category in at least two ACFI domains;

- Do not yet have an ACFI classification;

- Are high care residential respite care residents; or

- Are subject to specific grand-parenting arrangements relating to 2008 and 2010 reforms.

The latest Department interpretation of Specified Care and Services can be found here.

Providers are also permitted to charge fees for services that are not provided under the confines of Specified Care and Services. If they wish to charge for these services, they will need to comply with the requirements under Division 56-1(e) of the Act. Separately, the Act sets out rules including deductions that can be made against refundable deposits under Division 52J.

In order to be eligible, the Department considers that the service must not form part of the “normal operation of an aged care home”. This means that if a provider is unable to charge an additional fee if the service is routinely provided to residents, even if the service falls outside the realm of Specified Care and Service.

This is a concept that is not defined under the Act, and suggests that a provider is unable to charge an additional fee if the service is routinely provided to residents, even if the service falls outside the Specified Care and Services package. This is inherently contradictory to what the Act otherwise allows under Division 56.

The Department has also stated that the services cannot be charged “unless the resident receives a direct benefit or has the capacity to take up or make use of the services”, meaning that services must be wanted, measurable and deliverable.

Again, there is no legislative support for this statement and the ordinary principles of contract should apply. The Act permits ‘extra services’, which as a concept under the Act is a bundle of services, some of which residents may or may not utilise by choice or capacity. There is some argument, therefore, that residents should be permitted the option to agree to receiving additional services that are offered as a bundle when they first enter a facility.

Residents are able to pay the fee or agree to a deduction to be made from the RAD.

ADDITIONAL SERVICES CAN BE CHARGED IF THE SERVICE:

- Does not fall within the scope of Specified Care and Services;

- Falls within the scope of Specified Care and Services but where the resident does not have an assessed need for the service and the resident does not have high care needs; and

- Is charged in the amount agreed upon beforehand, with the care recipient, and if the provider provides an itemised account of the service.

Recommendations

Ansell Strategic and Gadens Lawyers have been advising a large number of providers on funding and pricing strategies following the recent ACFI cuts.

In light of the ACFI cuts and the resultant loss of revenue, we recommend that providers actively pursue additional service income by charging for non-specified services that have traditionally been provided in the past without charge. Further, we recommend that providers also seek new opportunities, and revenue streams, for additional services that meet the needs and preferences of both current and future residents.

These services should:

- Meet the needs and preferences of your residents;

- Not be included in Specified Care and Services unless the resident has lower care needs and you have assessed that the service is not required by the resident;

- Be differentiated from your “normal” services. The provision of woven cloth labels, for example, can only be included as additional services if you offer a standard option (such as staff writing on clothes in pen);

- Not be deemed an assessed need if care services are provided;

- Provided on a voluntary basis;

- Be agreed upon. Services should be formerly documented in an agreement to demonstrate that the resident has agreed to the service; and

- Be invoiced to the resident, even if the service cost is deducted from the RAD, to ensure that the resident is aware of the The invoice must be itemised in accordance with section 56-1(e) of the Act.

The Aged Care Act clearly states that providers are permitted to charge for additional services. The rules, however, have become unclear and the Department have indicated that they will not tolerate the charging of fees and charges outside of those specified by the Act.

The implementation of services should therefore follow appropriate market, cost-benefit and legal analysis. The use of advisors who are already familiar with the legislation and current practices of other providers is essential.

Operational Strategy

Ansell Strategic

Partner

Gadens Lawyers